Tate & Lyle sells controlling stake of corn-based products arm to private equity

Dive Brief:

- Tate & Lyle entered into an agreement to sell a controlling stake in its Primary Products division — which makes corn-derived sweeteners, industrial starches and acidulants in North America and Brazil — to private equity firm KPS Capital Partners. The division, referred to as “NewCo” in releases about the deal, has an enterprise value of $1.7 billion. The transaction is expected to close in early 2022.

- The deal repositions Tate & Lyle as a food and beverage solutions business focused on quickly growing specialty ingredient markets, including sugar and calorie reduction, and adding fiber, texture and stabilizers. Tate & Lyle will still own 50% of the assets of the part of the company it is selling control of. The deal includes 20-year agreements for Tate & Lyle product manufacturing in facilities that are a part of the transaction.

- Tate & Lyle has been teasing a deal like this since April, when it issued a press release responding to reports speculating the company would be selling its largest division. On Tate & Lyle’s call with analysts following the release of its annual report in May, CEO Nick Hampton and CFO Vivid Sehgal further described why and how such a deal could happen.

Dive Insight:

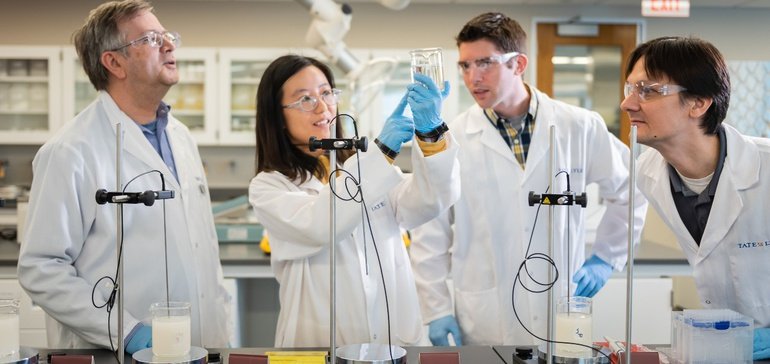

With this sale, Tate & Lyle will transform itself from an old school corn-based products business to a high-tech enterprise with science at its core. The business Tate & Lyle is splitting off was founded in 1906 as the A.E. Staley Manufacturing Company, and has a long history of making products in the U.S. and Brazil, according to a KPS press release about the sale.

For a company that wants to be known for its next-generation sweeteners and ingredients, this sale will accomplish that goal. It transforms Tate & Lyle’s identity, as well as gives it the capital and freedom to invest deeper in the science that can make the company a more prominent force in the ingredients world. And importantly, in a time when commodity prices are beginning to fluctuate, Tate & Lyle’s financial fortunes will not be as greatly dictated by the price of corn, Hampton said on a conference call to discuss the agreement.

“In short, the new Tate & Lyle will be a high-quality, growth-focused specialty business operating in exciting segments of the food and beverage market that are seeing significant growth,” Hampton said during prerecorded remarks about the deal.

While KPS’ current portfolio has no other food companies, this deal makes sense for the private equity firm, which has been known to reinvigorate industrial manufacturing businesses. While this division is not struggling or in need of significant investment, an owner who knows manufacturing can help it continue to succeed. A February Tate & Lyle presentation defined this division as high volume and largely undifferentiated ingredients that compete primarily on quality, service and price, and KPS estimated annual revenues of the business at $2.3 billion. According to the KPS release, the business has about 1,700 employees across six manufacturing facilities in the U.S. and Brazil.

Another unique aspect of this deal for Tate & Lyle is that it will still have a significant stake in the profits that come from the Primary Products division, though KPS will control the board and make the decisions. In fact, Tate & Lyle said in a written statement that it expects to receive $1.3 billion gross proceeds from this sale — and half of that will go to Tate & Lyle shareholders as a special dividend. As time goes on, Hampton said in the prerecorded statement, money from NewCo’s products can help buoy Tate & Lyle’s investment in R&D infrastructure and new products.

When it comes to doubling down on its food and beverage business, the numbers are in Tate & Lyle’s favor. Sales of sweeteners, with the exception of sucralose, have increased at a compound annual growth rate of 20% in the last three years, Hampton said. In the same time period, texturizing products have had a CAGR of 30%, and soluble fiber revenue has grown by 50%. New product revenue in this division has more than doubled in the last five years, and is now worth about 14% of what the company makes, Hampton said. As a result of this transaction, the company plans to increase R&D spend at its 17 labs worldwide, and by 2026, a fifth of its revenues are expected to come from new products, he said.

It seems Tate & Lyle is getting the best possible deal in this sale. It is selling a stagnant — but still lucrative — part of its portfolio to someone else that will run it, and continue to reap the financial benefits. It’s investing in areas of the business that have been dynamic and growing.

The deal also leaves Tate & Lyle with no new debt, Hampton said during a live Q&A session after the announcement. Therefore, it can more easily use M&A to build its position as a new ingredients company. Tate & Lyle recently made two acquisitions to bolster this division: the December purchase of stevia producer Sweet Green Fields and October’s deal for an 85% stake in Thailand-based tapioca maker Chaodee Modified Starch. As the deal completes, it will be interesting to see where Tate & Lyle begins as it revamps itself.

Source: fooddive.com