The illusion of choice: five stats that expose America’s food monopoly crisis | Food & drink industry

When you walk into a US grocery store the shelves seem to be teeming with choice, with countless brands appearing to offer every type of food and drink.

But a joint investigation published this week by the Guardian and Food and Water Watch showed how this choice is largely an illusion. In fact, a handful of mega firms dominate every link of the food supply chain: from seeds and fertilizers to slaughterhouses and supermarkets to cereals and beers.

And that is not good news for consumers in terms of choice and real competition on prices, or for small and medium-sized farmers given little choice on what they grow or which animals they raise, while food industry workers face low pay and high risks.

The planet also loses out when industrial agriculture is focused on extracting maximum profits for minimum costs – an exploitative model with grave consequences for animal welfare, water, land and global heating.

“It’s a system designed to funnel money into the hands of corporate shareholders and executives while exploiting farmers and workers and deceiving consumers about choice, abundance and efficiency,” said Amanda Starbuck, a policy analyst at Food & Water Watch.

Here are some of the key figures and charts from our deep analysis of sales data from thousands of supermarkets across the US:

1. Almost 80% of dozens of everyday grocery items are supplied by just a handful of companies

Our research started by identifying dozens of different key grocery types that Americans buy every day, including different kinds of veggies, fruits and grains, prepared foods, beverages and animal products.

We then studied the scanner sales data from thousands of US stores that is compiled by market research firms for these products.

And our analysis revealed that a shocking 79% of the groceries in a basket of 61 everyday types of food and drink are being sold by a small amount of the top companies, which we defined to mean four firms or fewer.

It’s widely agreed that consumers, farmers, small food companies and the planet lose out if the top four firms control 40% or more of total sales.

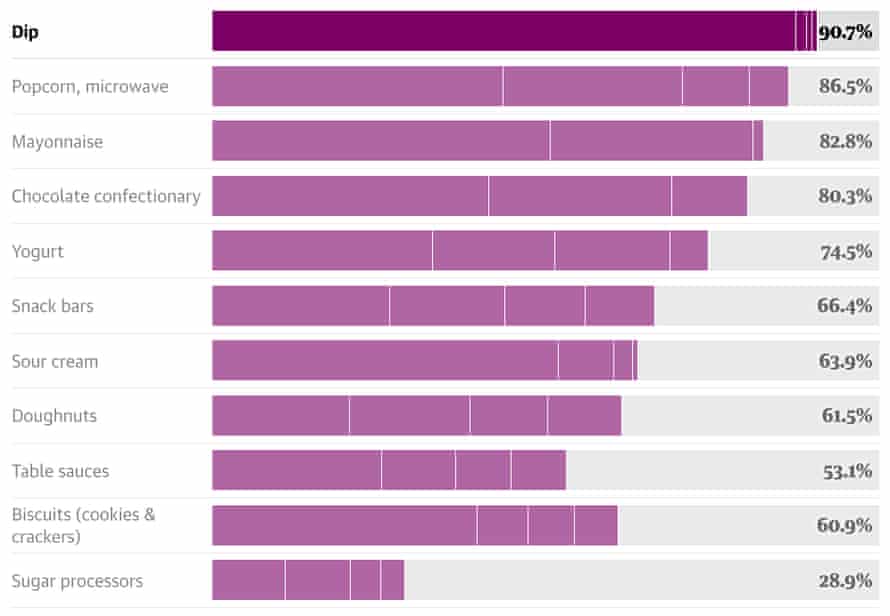

2. PepsiCo has a huge grip on the market for dips, with 88% of market share

Our analysis showed that the consolidation of the food system runs deep: four firms or fewer controlled at least 50% of the market for 79% of our 61 types of groceries. For almost a third of shopping items, the top firms controlled at least 75% of the market share.

The market for dips is a good example.

PepsiCo controls 88% of the dip market, as it owns five of the most popular brands including Tostitos, Lay’s and Fritos.

Snacks and condiments – market share for top three or four companies

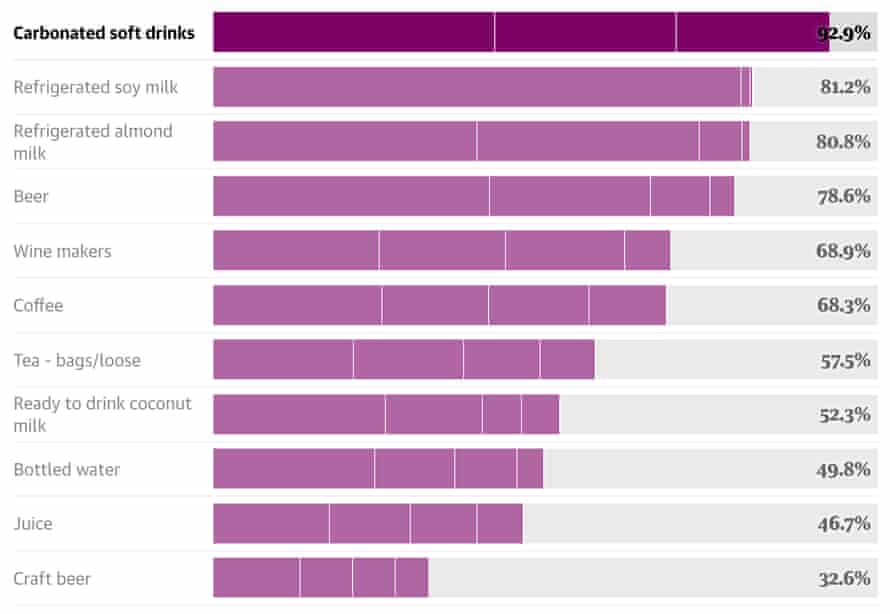

3. Ninety-three per cent of the sodas we drink are owned by just three companies

In the carbonated soft drinks category of our research the power of just three firms was overwhelming, accounting for 92.9% of sales in our analysis.

Coca-Cola has 42.4%, PepsiCo has 27.4% and Keurig Dr Pepper has 23.1%.

This kind of dominance is not good news if you are a smaller operator of a drinks company trying to get a toehold in the market.

Across all types of food and drink, the big firms are helped by so-called category captains in stores who represent leading brands or manufacturers and work with major retailers to decide which products get prominent spots on our supermarket shelves. This makes it very hard for new independent brands to get a break.

When they do get a tiny foothold, it rarely lasts. Take craft beers, a booming market thanks to hipsters and old-school beer enthusiasts, which is why new brands are quickly acquired by mega breweries. It’s not clear from the labels, but the Belgian beer giant Anheuser-Busch owns more than 600 brands, including mainstream favorites like Budweiser and Beck’s.

Beverages – market share for top three or four companies

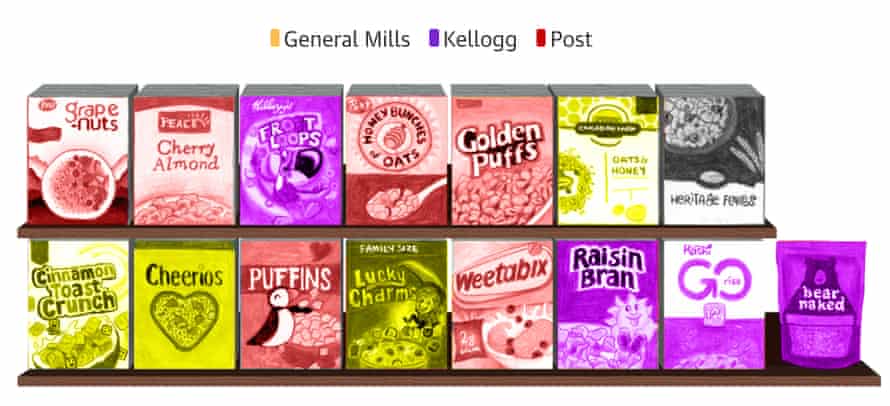

4. Just three firms dominate sales of 73% of the breakfast cereals we eat – despite shelves stacked with different boxes

We have all stood in front of a wall of cereal boxes in a supermarket and felt dizzy at the options. But really there is far less choice than you might think when you are deciding what cereal to have for breakfast.

Our research showed three firms dominate: General Mills with 27.9% market share, Kellogg Company with 26.8% and Post Holdings with 18.1%.

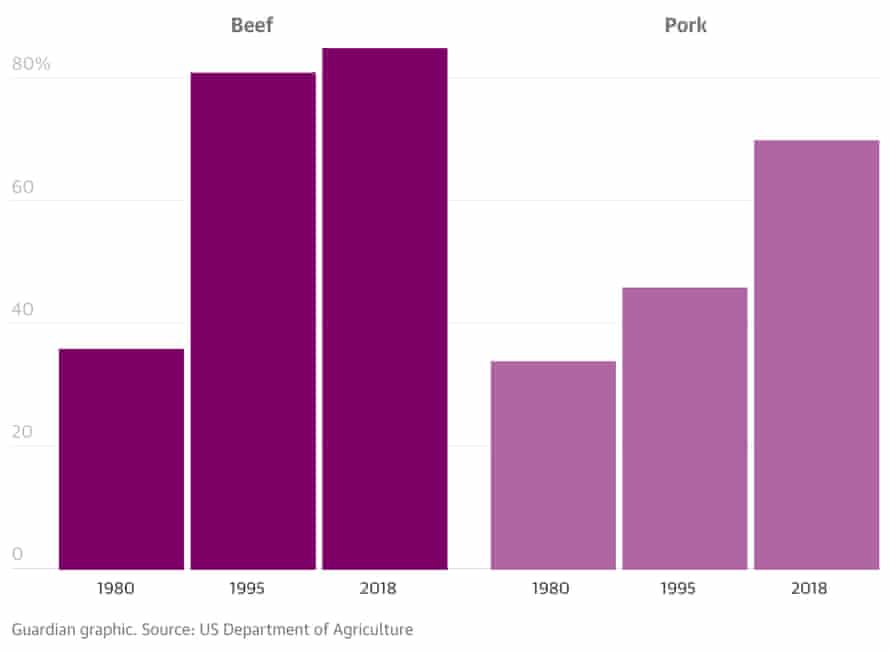

5. More than 80% of beef processing and 70% of pork processing is controlled by four multinational giants

A spate of mega-mergers means that meatpacking plants are now controlled by just a handful of multinationals including Tyson, JBS, Cargill and Smithfield (now owned by the Chinese multinational WH Group).

Forty years ago only a third of the beef and pork processing industry was controlled by the top four firms.

But after a spate of mega mergers 80% of beef processing and 70% of pork processing is controlled by four multinational giants. In 2017, these top firms had a combined revenue of $207bn.

Portion of meat market controlled by the Top 4 companies

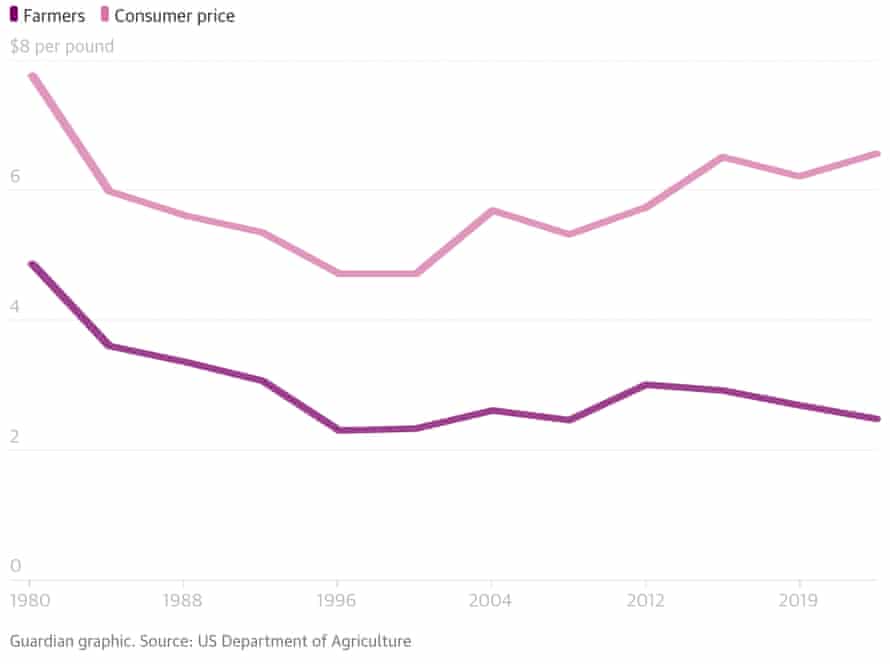

Meanwhile farmers and consumers lost out. In the last 40 years these huge corporations have been paying farmers less and less for beef and selling it to consumers at increasing prices.

How much farmers are paid for beef, and how much distributors sell it for

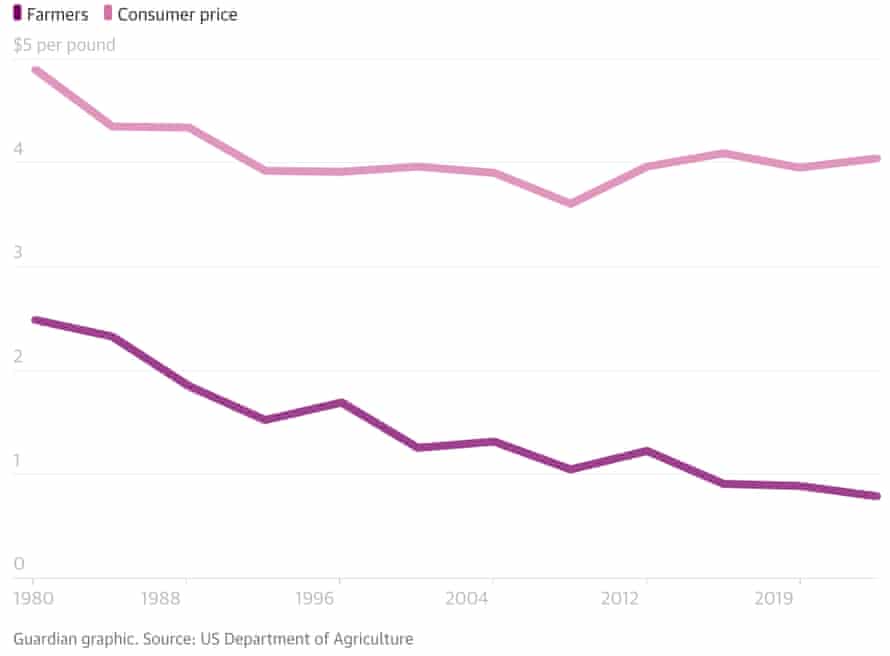

Pork prices have stayed steady for consumers, but farmers have been getting paid less and less.

How much farmers are paid for pork, and how much distributors sell it for

So what can be done?

Last week Joe Biden signed an executive order to tackle the rampant concentration across the US economy – including food and farming. Biden called on government agencies to enforce existing anti-trust laws and consider rolling back recent mega-mergers, which boosted profits and power for a handful of corporations while hurting the rest of us. The order specifically directs the USDA to take swift action to protect farmers, including by making it easier for them to sue meat processors for alleged abuses.

But the problems in the current system run deep.

“From farm to fork, America’s food system has been rooted in the exploitation of women, Native Americans and people of color. This is at the heart of capitalist food politics – big corporations taking as much as they can and paying as little as possible for it,” said Raj Patel, an academic and the author of Stuffed and Starved: Markets, Power and the Hidden Battle for the World’s Food System.

In addition to executive actions, which could be overturned by the next president, such deep-rooted injustices need sweeping reforms by Congress. But bills banning new mega-mergers and factory farms currently lack bipartisan support, despite public opinion supporting them.

It’s time to support small-scale regenerative farmers, regional food hubs and grocery co-ops, according to Starbuck, the policy analyst at Food & Water Watch. “Alternatives already exist. We just need to boost public funding and resources to help sustainable, affordable, more equitable food systems take root.”

Source: theguardian.com