Turkey significantly expands lentil production

One of the top buyers of Canadian lentils is greatly expanding its own plantings but yields could be way down due to a prolonged drought.

Turkey may increase its lentil acres by up to 30 percent, according to Armada Foods, a major Turkish importer-exporter and processor of pulses.

The huge expansion of acres will come at the expense of wheat.

Fethi Sonmez, chief executive officer of Armada, said fertilizer is a necessity for growing wheat on non-irrigated lands in Turkey.

But the meteoric rise in the price of fertilizers combined with the severe devaluation of the Turkish lira are pushing farmers away from growing wheat and into lentils and chickpeas, he said.

The other factor is that the Turkish government has been adjusting the market value of wheat since the beginning of the crop year to battle high inflation rates in the country.

“This resulted in the general public consuming lower-priced wheat-derivative carbohydrates but this came at the expense of the Turkish farmer,” Sonmez said in an email.

“The return from wheat did not meet many of the farmers’ expectations, therefore they will be shifting away from it come next season.”

The big swing from wheat to lentil production doesn’t necessarily mean Turkey will harvest a bumper crop of lentils due to what is shaping up to be the second consecutive year of drought.

“What is for certain at this time is that the subsoil moisture levels are abnormally low,” said Sonmez.

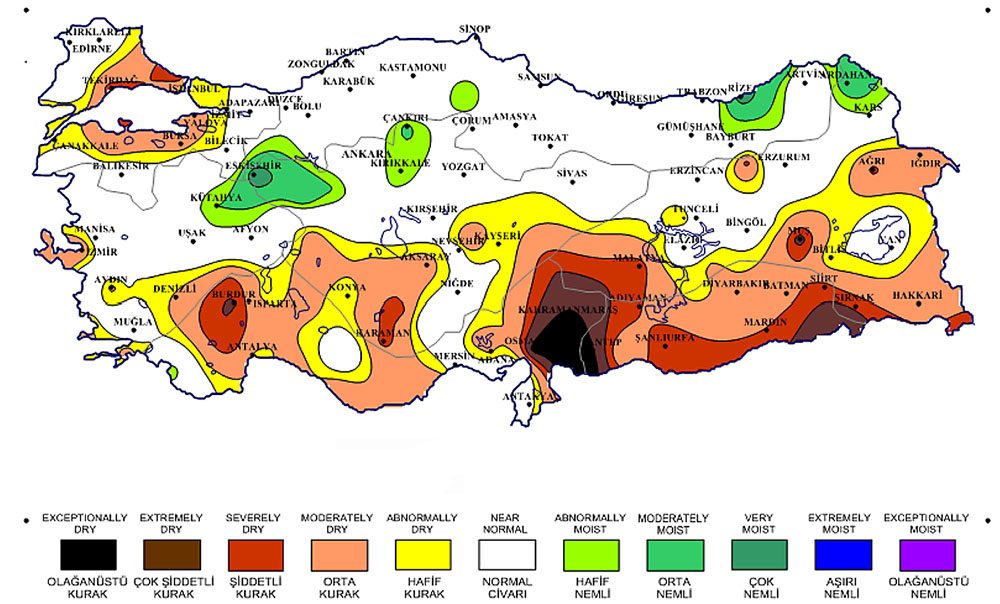

A soil moisture map shows that much of the country is experiencing moderate to exceptional drought, including the southwest where many major crops are grown.

It is too early to know if yields will be as dismal as they were in 2021 but they will be below the five-year average, he said.

The fate of the crop will be decided by the amount of rainfall that occurs over the next few months. Turkey’s pulses are planted in October through December and harvested in June.

The Turkish Statistical Institute (TURKSTAT) estimates that wheat production fell 14 percent in 2021 to 17.7 million tonnes, while red lentil production plummeted 30 percent to 230,000 tonnes.

Sonmez is forecasting a return to more normal lentil imports for Turkey in 2022. The days of bringing in 500,000 tonnes per year to meet surging COVID-19 demand are over.

“It is safe to say that even though life is not back to pre-COVID norms, purchasing behaviour is,” he said.

“Therefore, Turkey is back to importing 250,000 to 300,000 (tonnes) of lentils per year.”

But that will depend on prices. If red lentil prices remain above US$1,000 per tonne cost and freight, purchases would be curtailed.

“If the new crop values are closer to the 10-year average values, then the 250,000 to 300,000 tonnes of imports has a stronger chance of happening,” said Sonmez.

Canada shipped 215,700 tonnes of lentils to Turkey in 2020-21, according to the Canadian Grain Commission.

Source: www.producer.com