Wheat prices expected to peak this winter

The tightness in high protein wheat markets bodes well for spring wheat prices, but farmers might have to wait until mid-winter to see the peak, says an analyst.

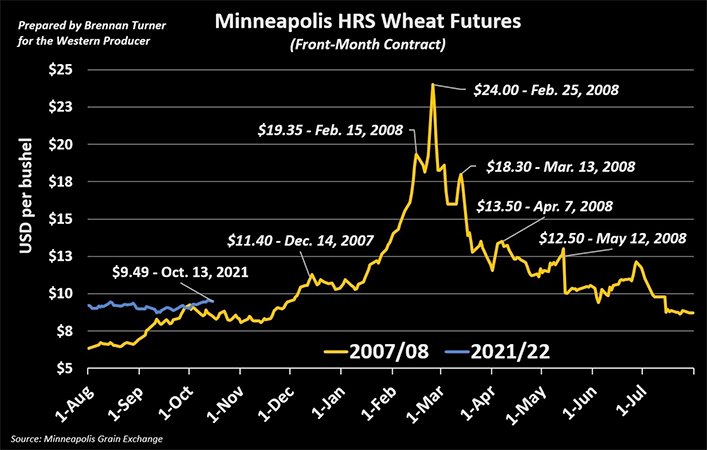

Brennan Turner, chief executive officer of the crop marketing hub Combyne, said this year is reminiscent of 2007-08.

Canada had a similar disappointing level of spring wheat production back then, and export prospects were also about the same.

Prices at the beginning of that year’s campaign were about the same as they are today.

They started to steadily climb when the calendar flipped to 2008, peaking at a whopping US$24 per bu. on Feb. 25 before dropping back down to the $9 level by the end of the year.

Turner isn’t saying farmers should count on values more than doubling once again this year, but he does believe there could be a similar pattern where there could be some “pretty explosive pricing activity” in the first quarter of 2022.

“It’s hard not to be bullish for hard red spring wheat prices,” he said.

That sentiment is shared by Bilal Muftuoglu, deputy editor for agricultural markets with Argus Media, a British company that tracks Canada Western Red Spring wheat prices.

He said during a recent webinar organized by the Alberta Wheat Commission that the supply and demand situation for high protein wheat is extremely tight globally.

One contributing factor that few are talking about is that China may have a significant wheat quality problem that could exacerbate that tight balance sheet.

The U.S. Department of Agriculture estimates China produced a record 136.9 million tonnes of wheat this year.

However, during the last few months of the growing season there was above-average rainfall in key production areas such as Hebei, Anhui and the Yangtze River basin.

“China could have the same problem that France and much of Western Europe had with crop quality,” said Muftuoglu.

FranceAgriMer estimates only 30 percent of France’s wheat crop will meet milling specifications, with the remainder being sold as feed.

China has already reduced its test weight requirements to accommodate some of the poor quality French wheat exports.

“Clearly they are taking precautions for a potentially lower milling wheat supply domestically,” he said.

China is also aware that milling wheat supplies are shrinking globally with production problems in Canada, the United States and Russia and the quality issues in France.

Muftuoglu believes the quality problems in China are behind the recent surge in Chinese wheat prices to record levels of US$400 per tonne.

Canada was the leading exporter of wheat to China in 2020-21, supplying 3.5 million tonnes of the 10.6 million tonnes that the country purchased. The U.S., France and Australia were the other main suppliers.

The USDA expects China to import another 10 million tonnes of the crop in 2021-22, but Muftuoglu believes the total could be higher due to the quality issues.

He said France won’t be able to supply China with much of its milling wheat needs because of its own quality problems and sky-high freight rates.

Australia is harvesting another bumper crop of wheat. The USDA is forecasting a near-record 24.5 million tonnes of exports from that country, up from 22 million tonnes last year.

China is in the midst of a political spat with Australia and seldom buys more than two million tonnes from that country.

As a result, it will need to import a lot of milling wheat from Canada and the U.S., although both of those exporters had disappointing harvests.

Australia gained back significant market share in other Southeast Asian countries such as Indonesia, Vietnam and the Philippines last year.

That trend is expected to continue because of Australia’s bumper crop, the dismal harvests in Canada and the U.S. and Australia’s huge and growing freight rate advantage into those markets.

Indonesia started importing huge volumes from Australia and reducing its purchases from Canada at the beginning of 2021 when it became apparent that Australia was going to have another big crop.

Canada will also face stiff competition from Ukraine in its second largest market. Indonesia already imported 2.3 million tonnes from Ukraine in the first three months of 2021-22 compared to 2.6 million tonnes all of last year.

Ukraine’s exports usually slow down in December, but this year’s program will stay active well into 2022 because of a 33 million tonne bumper crop.

Muftuoglu said milling wheat prices in Europe are close to record levels for this time of the year and haven’t pushed above that resistance level.

The same goes for the U.S., where the Chicago soft red wheat-to-corn spread has historically been trapped in a band of $25 to $75 per tonne.

“If we’re going to see that spread widen, we’re going to need to see some support from corn, which is not happening at the moment,” he said.

Contact sean.pratt@producer.com

Source: www.producer.com